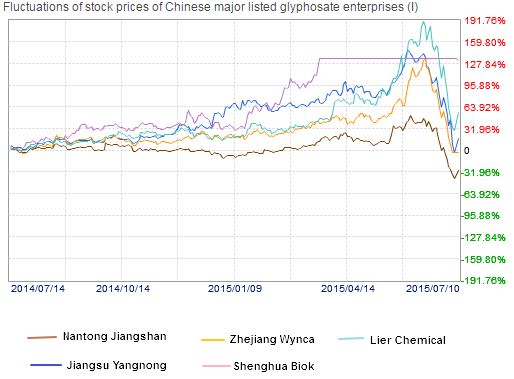

The recent crash in China has wiped

trillions of dollars off the value of China’s two main stock exchanges in

Shanghai and Shenzhen. Between June 12 and July 10, each exchange lost 25% and

33% of its value respectively.

Many of China’s leading glyphosate

producers are publicly listed, and they have not escaped the fallout. Here is a

quick roundup of how badly each has been affected and the tactics they have

adopted in an attempt to mitigate the damage:

Source: Sina.com.cn

Nantong

Jiangshan

Nantong Jiangshan’s stock price has

plunged 48% in the past month, from USD7.19/share (RMB43.97/share) to

USD3.48/share (RMB21.25/share).

On July 10, the company made an

announcement with three key promises designed to reassure shareholders and

stabilize its share price:

1.

It announced that Sinochem

International Corporation and Nantong Industries Holding Group, the company’s

two largest shareholders have promised not to reduce their stock holdings for

at least the next six months

2.

Nantong Jiangshan’s directors,

supervisors and senior executives have also guaranteed that they will not sell

any company shares for six months

3.

The company pledged to undertake

further measures to placate its shareholders, including offering equity

incentives.

Zhejiang

Wynca

Zhejiang Wynca’s shares dipped even

more dramatically over the same period, from USD3.38/share (RMB20.64/share) to

USD1.41/share (RMB8.62/share), a decline of over 58%.

This prompted the company to

initiate a trading halt on July 8. This temporary reprieve gave the company

time to reorganize its finances:

·

On July 11, Zhejiang Wynca

announced that it would invest USD4 million (RMB25 million) to increase its

equity in Chongyao (Shanghai) Technology to 50%.

·

Meanwhile, the company raised

USD24.9 million (RMB152.3 million) by selling 5.68 million shares (or 33.4%

equity) in Hangzhou Research Institute of Chemical Technology to Zhejiang Jolly

Holding Group at USD4.4/share (RMB26.8/share).

On July 13, the company resumed

trading.

Lier

Chemical

The crash has knocked 46.5% off the

share price of Lier Chemical in the past month, from USD6.1/share

(RMB37.5/share) to USD3.3/share (RMB20.1/share).

This has prompted the company to adopt

a number of tactics in a bid to contain the panic:

·

Lier Chemical has encouraged

shareholders to increase their stock holdings. Sichuan Forever Holding Co. has

already agreed to increase its equity and not to reduce its holdings for at

least six months

·

The company has also encouraged

senior executives to increase their holdings. Gao Wen, the director of Lier

Chemical, bought 100,000 shares and more purchases could follow in the near

future

·

The company directors, supervisors

and senior executives have also released a commitment to not reduce their stock

holdings for the next six months

·

Lier Chemical will refinance

through a share placement. The company’s three largest shareholders (which

between them own over 60% of the shares) have all agreed to fully subscribe the

share placement.

Jiangsu

Yangnong

Jiangsu Yangnong’s stocks have

taken a 51.7% hit in the past month, falling from USD8.0/share (RMB49.1/share)

to USD3.9/share (RMB23.7/share).

Shenghua

Biok

Fortunately for Shenghua Biok, it

has been under a trading halt since March due to an ongoing non-public

offering, meaning that the company has been shielded from the effects of the

crash up to this point.

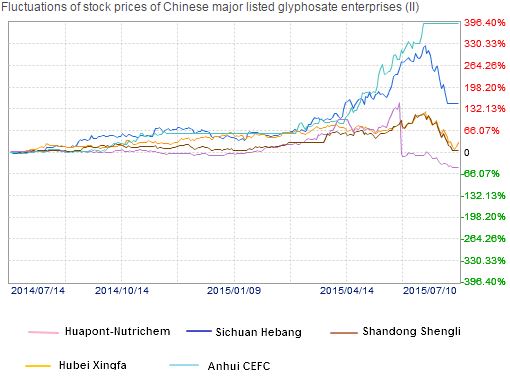

Source: Sina.com.cn

Shandong

Shengli

Shandong Shengli’s stock price has

slumped by 52%, from USD2.1/share (RMB12.5/share) to USD1.0/share

(RMB6.0/share).

This prompted the company to halt

trading on its stocks on July 8 on the grounds that it was planning some major

issues. Three days later, the company announced that it would be taking four

measures to ensure future stability:

1.

Shareholders and senior executives

promised to increase their stock holdings over the next twelve months

2.

Shandong Shengli would also

encourage its staff to increase their stock holdings through an ESOP, equity

incentives and other methods

3.

The company promised that no

shareholders with over a 5% stake in the company, directors, supervisors or

senior executives would reduce their holdings through the secondary market

4.

The company also vowed to

accelerate its strategic transformation through mergers and acquisitions, with

the goal of restructuring its business towards the clean energy and natural gas

sectors.

CEFC

Anhui

CEFC Anhui halted trading on its

stocks on June 15 for an assets reorganization, so it managed to largely avoid the

effects of the crash. However, industry insiders worry that its stock price may

plummet as soon as trading resumes.

Sichuan

Hebang

Sichuan Hebang also halted trading,

though slightly later on July 3, as the company was planning to set up a

private bank through sponsorships. However, on July 11 Sichuan Hebang was

forced to announce that this plan had failed to win government approval and

trading on its stocks resumed on July 13.

Between June 12 and July 10,

Sichuan Hebang’s shares declined 41% in value from USD4.7/share (RMB28.5/share)

to USD2.8/share (RMB16.9/share).

Hubei

Xingfa

Hubei Xingfa released a statement

on July 10 with the following announcements:

1.

Yichang Xingfa Group, the controlling

shareholder of Hubei Xingfa, plans to invest at least USD3.3 million (RMB20

million) in increasing its holdings in the company within the next two months

2.

Hubei Dingming Investment also

plans to invest at least USD1.6 million (RMB10 million) in the company within

the next six months

3.

Hubei Xingfa pledges that if its

closing stock prices are lower than the net asset value per share audited in

2014 for five trading days or more during the period July 9 – September 9, the

company will initiate a share buy-back scheme.

CCM

will continue monitoring closely how China’s glyphosate market is affected by

the crash and we will release regular updates on the situation in our Glyphosate E-Journal.

For

more information on CCM and our coverage of China’s agrochemicals market,

please visit www.cnchemicals.com or get in touch directly by

emailing econtact@cnchemicals.com or calling +86-20-37616606.